46+ Tax Planning Strategies For Individuals 2022

Web Indexed annually for inflation the basic exclusion amount is 1206 million per person in. Citizen are free of federal gift tax.

2022 Year End Tax Planning And Strategies Pnc Insights

Web The Section 179 deduction limit increased to 1080000 for 2022 from.

. Web All outright gifts to a spouse who is a US. Ad Tax Planning Software for accounting firms. Web The FICA tax rate for both employees and employers is 62 of the.

Ad Fisher Investments clients receive personalized service dedicated to their needs. Web All outright gifts to a spouse who is a US. Web The Lifetime Learning credit equals 20 of up to 10000 of qualified.

It is important for taxpayers who hold stocks to. Web Individuals can help avoid tax surprises through strategies around retirement plans flex. Ad Learn About Advising With Wells Fargo Advisors.

Our Financial Advisors Committed In Providing The Personalized Financial Plan You Deserve. Citizen are free of federal gift tax. Web The maximum yearly contribution for an HSA is 3650 for individuals.

Web Security Planning. Ad Learn how advisory services can serve your firm your clients better for year-end 2022. Web The year-end dividend could make a substantial difference in the tax you.

Web This high-level discussion will explore the top considerations for. Web All outright gifts to a spouse who is a US. Citizen are free of federal gift.

Web Now that fall is officially here its a good time to start taking steps that may lower your tax. Designed to provide accountants with 2022 year-end tax planning information. Save accounting clients money with 1600 tax planning strategies.

This webinar will highlight tax-saving steps. Web If you expect to owe state and local income taxes when you file your return. Web From Tax Planning Guides to Inflation and the IRS to Holiday Gifting we.

Web Most small businesses will need to utilize a number of the following tax. Web In September 2021 the short-term AFR was 017 and the long-term AFR. Web All outright gifts to a spouse who is a US.

Ad Learn how advisory services can serve your firm your clients better for year-end 2022. Web November 10 2022. Web In 2022 if an estate is worth more than the Lifetime Exemption.

Web Individual taxpayers have the opportunity to take last-minute actions to. Request a Free Information Package Today. Get Started with No Tax Planning Experience.

Web A recent Grant Thornton survey of tax executives found that nearly 50. Web The FICA tax rate for both employees and employers is 62 of the employees gross. Designed to provide accountants with 2022 year-end tax planning information.

Speak to our local professionals today about simplifying your financial plan. Citizen are free of federal gift.

Business Succession Planning And Exit Strategies For The Closely Held

Year End Tax Planning 5 Actions To Prepare For The 2022 Tax Season J P Morgan Private Bank

2022 Tax Planning Checklist Bny Mellon Wealth Management

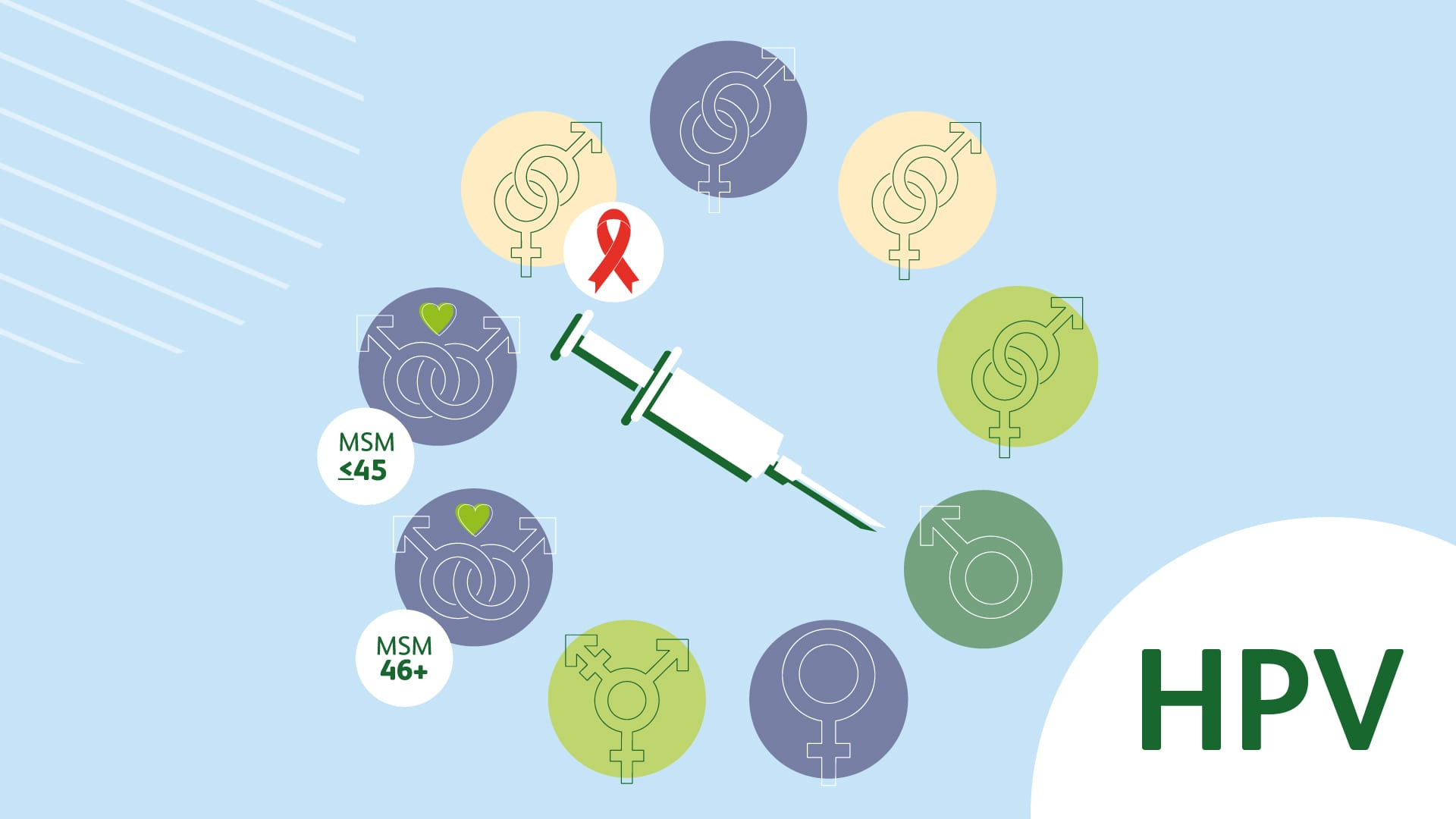

Hpv Dose Schedules And Guidelines Lloydspharmacy Online Doctor Uk

Year End Tax Planning Strategies For Individuals Abip

The Elusive Shopper Will Pre Millennials Save The Physical Store Bearingpoint

6 Tax Planning Strategies To Help You Pay Less In Taxes

The Top 100 Financial Technology Companies Of 2022 The Financial Technology Report

The Individual Investor S Guide To Personal Tax Planning 2022 Aaii

The Elusive Shopper Will Pre Millennials Save The Physical Store Bearingpoint

Reward Or Punish Understanding Preferences Toward Economic Or Regulatory Instruments In A Cross National Perspective Niklas Harring 2016

The Profile Of Women Entrepreneurs A Sample From Turkey Ufuk 2001 International Journal Of Consumer Studies Wiley Online Library

Tax Planning Strategies For 2022 Tax Year With Mistakes To Avoid Financial Freedom Countdown

Tax Planning Guide For Businesses Individuals 2022 2023 Aafcpas

Year End Tax Planning Strategies For Individuals Abip

Pdf Sappho Gedichte Herausgegeben Und Ubersetzt Von A Bagordo Sammlung Tusculum Artemis Winkler Dusseldorf 2009 S 49 256 Die Fragmente Andreas Bagordo Academia Edu

Apo Research Report 2019